In ASEAN Thailand is the second-largest economy and a significant tourist destination globally. This consumer-driven and the dynamic market is growing its demand for imported food and beverages, offering several opportunities for overseas exporters.

Due to urbanization in Thailand over the last few decades, the increase in economic growth has resulted to an increase in demand for higher-value fresh and processed products amongst the highly-educated, middle and upper-income population in Thailand. Health consideration, rather than price, is becoming a key purchasing factor in the people of Thailand (especially in Bangkok). The metropolitan area in Bangkok remains Thailand’s largest consumer-driven market but increased tourism and higher disposable incomes are also fuelling extra demand for quality food and beverages.

Thailand is recognized as among the world’s leading suppliers of agricultural products, which is driven by a developed food processing sector. The agricultural sector in Thailand contributes 10 percent of the total country’s GDP and occupies around 40-50 percent of the labour force. The major food exports include seafood products, rice, meat, sugar, vegetables, and fruits.

Thailand is known for supplying frozen shrimp as Thailand is the world’s largest supplier of frozen shrimp and is a major exporter of chicken and chicken meat. On the other hand, it is also a leading importer of agricultural products, which includes a wide range of food ingredients, food and beverage products. The main food and beverage which Thailand imports are soybeans dairy products. The consumption of soybeans is increasing day by day.

Due to some political instability and economic downturn in Thailand, the Thai food producers have decelerated their investment in purchases of new machinery and manufacturing facilities. This resulted in a decrease in the imports of food processing and packaging equipment as well as a decrease in the local production. Though, the Thailand food’s exports remained strong as the food processing sector continues to recover its productivity and capitalize on its abundant source of high quality local raw materials.

World’s 7th largest food producer is Thailand with food processing and packing machinery imports about £1.3 billion a year.

| Foreign Direct Investment across sectors in Thailand | |

| Sector | Total FDI (billion dollars) |

| Automotive | 1.949 |

| Electrical | 1.766 |

| Petrochemicals | 1.058 |

| Textiles | 0.369 |

| Agro-processing | 0.335 |

| Tourism | 0.262 |

| Medical | 0.194 |

| Aerospace | 0.078 |

| Digital | 0.051 |

| Robotics | 0.035 |

| Data: Thailand Investment Review, February 2017, vol.27 no.2 | |

Thai Government Is Stepping Up “Thailand 4.0” Towards Agro-Processing

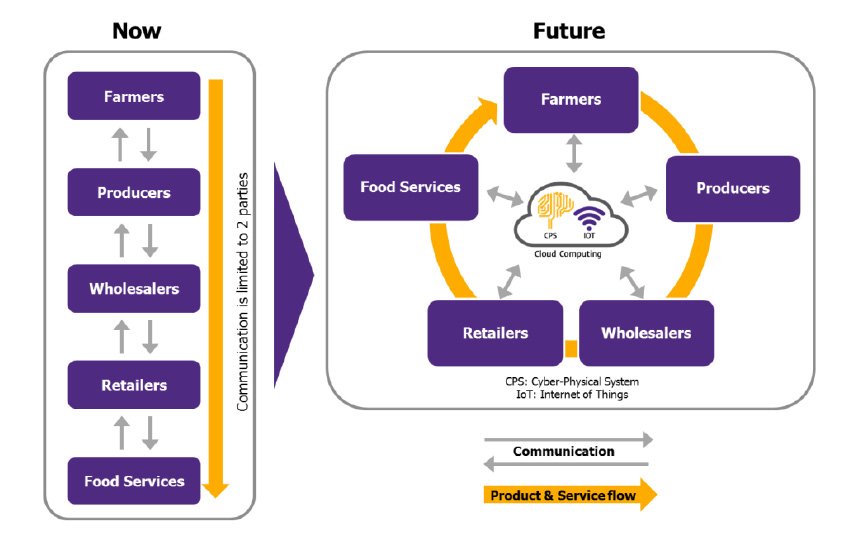

The government of Thailand has announced a new model for its industrial development for enhancing the prospects of Thai businesses and assist them in competing in the ever-changing 21st century. This new model is “Thailand 4.0” and the key concepts comprises of evolving from the manufacturer of Mass Products to Innovative Products with the help of creativity, technology and new methodologies, and also transforming from a production-based to a service-based economy with the help of digital system as part of this transformation. This model covers 5 key industries, which includes Agriculture, Food and Biotechnology, and purposes to incorporate the related businesses into the food production supply chain, from the upstream agricultural actions, processing, storage, packaging, and marketing, to distribution.

The focus of the country on food innovation shouldn’t come as a big surprise for anyone knowing Thailand along with its worldwide rated cuisine. Thailand is a farming dynamo and Thai people are extremely obsessed with food.

Approximately 40 percent of its population is engaged in the agriculture sector, and its food processing industry comprises of wide range of products (from seafood to energy drinks) that is exported to supermarket shelves all around the world.

The country’s strategic location i.e. at the center of Asia and its heavy investment in trade and logistics infrastructure makes Thailand a perfect gateway for 630 million people of ASEAN. The country also made a huge investment in the education sector. 24 universities spread across the country sees 7,000 students graduate per year with a background in biotechnology.

In the year 2016 alone, the BOI gave his approval to more than 320 agricultural projects valuing over 4.8 billion US Dollar.

Incentives are very compelling for innovative projects in fruit and vegetable food packaging, supplements and medical food, rubber science, biofuel manufacture and extraction of bio-active ingredients.

The Food Innopolis project

The Government of Thailand is stepping up campaigns to make country’s “Food Innopolis” a globally-known project. Government is also proposing to encourage entrepreneurs from the United States, Europe, Japan, New Zealand and Australia to invest in this project.

The Thailand Food Innopolis was launched last year in 2016 as a global food innovation hub. This was launched to support R&D and innovation for the food industry.

As of now, Food Innopolis compromises 32 food-related companies, 60 percent of those companies are Japanese entities and according to Dr. Atchaka Sibunruang (Minister of Science and Technology), more business entities from Europe and China are planning to participate in the Food Innopolis project in the near future.

Exceptional incentives from the BOI for those business entities will be granted tax holidays like 0 percent corporate tax up to ten years, exemptions from import duty and weighted tax deductions for Research and Development expenses (up to 300 percent).

Thailand is a leading supplier of a huge variety of commodities and products globally which includes rice, cassava, rubber, seafood, sugar, frozen food, poultry meat, ready-to-eat foods and processed fruits and vegetables.

Thailand is a regional and international food manufacturer and processor, especially for prawns and tuna. The Thai Union Group is the biggest and the largest processor of seafood products and commodities in the world. Thailand is home to one of the major and biggest agro-business conglomerates, the Charoen Pokphand Group (CP), which has massive investments and production in 20 or more countries around the globe. Other Thai agro-business conglomerates are looking at expansion and diversification globally.

Opportunities in Thailand

The country’s tourism and hospitality sector, featuring mostly the domestic and MNC hotel and restaurant chains, required substantial volumes of imported food products and related commodities. The food and beverage manufacturing sector also sources products worldwide and uses ingredients from Australia, which includes food additives, dairy products, cereals, and flavourings.

International cuisine has become gradually popular among people of Thailand. Imported food items needed to meet the demands of the foodservice industry include:

- smoked salmon and seafood

- fresh fruit and vegetables

- grain and cereal products

- Japanese-style delicacies

- 100 percent fruit juice and drinks

- jams and spreads

- chocolate and confectionery

- pasta

- salted snacks

- dairy products and milk powder

- ready-to-eat meals

- meat and meat by-products.

Thailand Board of Investment: Thailand Gears Up for Food Production to Serve the World

Thailand is stepping up to strengthen food supply with a generous investment program designed to cultivate innovation-driven projects. “Thailand 4.0” economic model offers generous incentives and tax exemptions to high tech companies that set up advanced manufacturing facilities in the country — including agro-processing and food for the future.

The government of Thailand is also staunch at its position to push the prospects of Thailand becoming the largest exporter of halal food in the world.

Thailand yearly exports the halal products to markets of more than 57 countries totaling to US$5 billion, making Thailand the world’s fifth-biggest exporter of halal food. The Halal Science Center is recognized globally as a first of its kind halal global science agency and is also trying in developing an internationally recognized standard for Halal certification.

The primary role of this Center is to emphasize on upliftment and standardization of high-standard quality of the Thai Halal Foods as per Islamic law and Codex Standard. The Center is also engaged in standardizing Halal certification with countries of ASEAN such as Indonesia and Malaysia. At present each countries have their own method and logo for granting Halal certification, and it could be confusing for tourists and travelers crossing borders in the ASEAN countries.

Future Outlook

In Asia, Thailand is the only net food exporter and would want to be in this rewarding position. The country is already facing stiff competition from other nations such as India and Vietnam in shrimp and rice, China in vegetables and fruits, Brazil in chicken and Malaysia in halal food. If Thailand wishes to build on its markets both globally and domestically, it needs to live up to the highest quality standards that are set specifically by the big export markets like the United States, the Japan and EU (European Union). The buoyancy of its domestic market also offers fantastic opportunities with massive growth sectors such as liquid products (including fruit juices, soft drinks, beer). As the lifestyles in Thailand change quickly towards the requirement for ease and more convenience in the preparation of food, there is specifically growth prospects in the areas of convenience and fast food, canning, snack foods, retail level bakeries and confectionary dairy products.

Hence, Thailand has not just made a mark in the food sector and while preserving its authority and control in large export markets such as the US and EU, Thailand is strategically and carefully making inroads into the markets like Russia, India and China.

Furthermore, recent indications are that the country is likely to get into a FTA (free trade agreement) with India in the near future. Thailand is also working with several countries in addressing the issues of non-tariff barriers to trade for promoting exports. Thailand has therefore developed a robust foothold in the food market credit and also equipped itself for facing a future which would be fiercely competitive.