Thailand is once named as “Siam” which is situated at the mid of the Indochinese in the locale of Southeast Asia. It is considered as the 51st biggest nation and it takes the twentieth spot in the most crowded nation among the world. It comprises 66 million individuals and it has rich conventions. Thailand has assembled exceptional trademark vision to the world. In Thailand, Bangkok is the most crowded city. Thailand turned into industrialized region recently and the bigger sent out in the year of 1990s. It goes about as driving in agribusiness, tourism and assembling divisions. Regarding agribusiness, Thailand is one of the main rice exporters and it considers as the most noteworthy product. The horticultural area has grown up to 4.1 % every year in the middle of 1963 to 1983and it preceded to 2.2% around 2007. At that point the administration and fares of products was increased. Thailand has completely taken an interest in territorial and worldwide associations. It has built up their connection with ASEAN individuals, for example, Singapore, Malaysia, Indonesia, The Philippines, Brunei, Cambodia, Vietnam, and Myanmar, whose financial pastors will arrange yearly gatherings. They have local participation in exchange, keeping money, political, financial and social matters. In present days, Thailand is partaking in universal stage.

Thailand Banking Services Have No Shortage

There are lots of banks in Thailand such as: Krung Thai Bank, Thai Bank, Kasikorn Bank, Bank of Bank of Ayudha and Siam commercial Bank. Also, there are some numbers of small sized government and commercial banks and you could also find the branches of European and American banks. Most Tourister uses the Thai banks only in order to exchange currencies. Residents who live longer in Thailand want to look for more banking services. If a bank account is opened, a person can use debit cards, ATM cards, and also can take benefit of internet banking. However, the initial process is to open a bank account. The process of opening an account varies from bank to bank or between bank branches.

Some Other Details Required Other Than Passport:

Aside from the copies of passport, work permit is required frequently, in light of the fact that few foreigners are living without working in Bangkok. For some odd reason on the off chance that anybody who needs to stay in Thailand nation with retirement visa, must have some cash deposited in bank of Thai. But, a few banks in Thai won’t permit to open an account before all else. Opening an account would be a constant issue, but as of now some branches are permitting foreigners to open accounts in their banks. On the off chance that a man is having an account in the bank, they can pull back their cash with no challenges through numerous ATMs which are situated in the Bangkok. The ATM may be located close to general stores, road corners and near any stores, and so on. In Thailand, ATM pool is accessible with, by which one can withdraw money from any bank ATM. No binding of accessing card in same bank ATM. In significant or in som conditions, user is not charged extra for this administration. With some additional compensation individual can get a platinum card that can be utilized to pay at retail chains and grocery stores. In the event that a man having spared or current record or settled record, they can issue passbook from the bank. But the pity thing here is that they can get month to month articulations only. The sum in the account has been imprinted in the passbook, and it will be redesigned by means of electronic utilities or at the bank.

Individuals Can Get More Benefits From Thai Bank:

Making payments through Thai banks can be entirely exhausting. A person can pay their phone charges, power bills through the web applications. The issue emerges when a man need to make payment at the other bank. More sums will be charged for this fundamental administration. With a specific end goal to lessen extreme expenses the individual must visit bank. That bank in the event that they need to make an installment on Bangkok Bank account. Getting the money for an outside check is likewise conceivable with this strategy. Charging expenses can change from bank to bank. Siam business Bank gets 200 Bhat for this administration, however, it is low why on the grounds that in different banks they are charging more than 1000 Bhat. On the off chance that anybody needs to move cash as far as little sum, they should examine about the charges the amount they have to pay for this administration. Despite the fact that a man has been client quite a while, some bank does not give insurance to attractive administration constantly. There is some administration possessed banks and they won’t give numerous keeping money administrations. There might be chances that you can’t get an ATM card as well however some private banks give loads of attractive administration.

Four important financial systems:

Thailand’s financial system can be dominated by banking sector. Due to global financial crisis the Thai economy had slowed down. Performance on Managing money and in banking affairs in between 1960s and 1970 were quite impressive which was fully taken care by Thai authorities and also it was good due to diversification and successful development of financial institutions. During 1980 and 1990, Thai financial institution processed under the supervision of the central Bank and The Bank of Thailand. In order to attain the perfect goal, such as changing Bangkok into a regional financial center, the Bangkok with international Banking Facilities (BIBFs) had been established in the year 1993. A Financial system in Thailand can be categorized into four major constituents. They are i) commercial banks, ii) Capital banks, iii) government owned financial institutions and iv) non- 2 bank financial institution finance companies, life insurance and credit fancier companies.

Oldest financial institution is the commercial bank:

Commercial banks are considered as the oldest financial institutions and it dominate the financial system. During the year 2009 March there were, 16 foreign bank branches, 14 domestic banks, one subsidiary and 3 retail banks. Thailand commercial banks allowed beginning universal banking. The bank can provide a large range of financial services in investment banking and traditional banking. The banks in local are fully focused on commercial banking, and it takes the interest about 80% from the total income. At present some banks are turning to SME business and retail banking from traditional corporate banking because they provided better profit and diversification.

Stability improved in commercial banks:

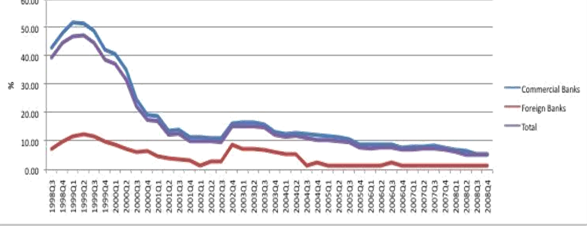

In Thai commercial banks there has been lot of improvement in the stability. The ratio of nonperforming loans to total loan was reduced steadily. Around the year 2008, the percentage of total loans is 8 and the ratio of nonperforming loans to total loans in foreign banks was low throughout the year. The below figure shows the ratio of gross NPLs and Total loans.

Gross NPLs/ Total Loans

Gross NPLs/ Total Loans

The stability improvement has created impact in CAR (Capital Adequacy Ratio) which is the bank’s capital ratio. It measures how the banks can take reasonable money of losses. Around the year 1997, the commercial bank value for CAR is about 10% and it reached 15% at the end of 2008.

Profit was higher in Thai commercial banks:

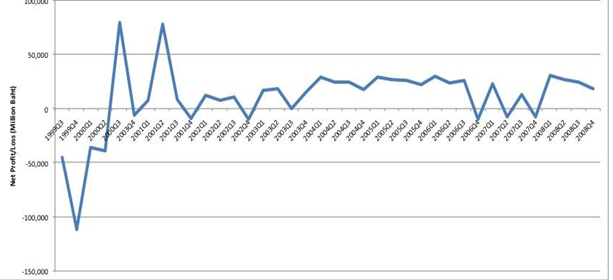

Commercial banks have lost more than 100,000 million Bhat. There is a huge change in the profit during 1999 – 2001. Since 2002, it had higher and lower volatile profits because of more net interest rate and forceful non- interest income. The below figure shows Commercial bank profit and loss.

Net interest loss of commercial banks

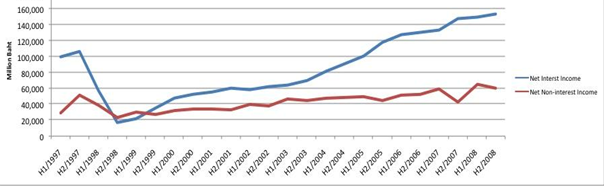

Net Interest and Non- interest income of commercial Banks

Capital Markets in Thailand:

The stock and bond markets are the most important constituent in the Thai financial system.

The stock Market: Thailand securities exchange has been established in 1975. It works underneath the legal framework, settled down in the act of securities and exchanges. Its main operation involves supervising of listed companies, trading, security listing, market surveillance, information dissemination, investor and disclosure.

The Bond Market: The bond market was introduced during 1905 first time. Thai government provided one million pounds as bond in London in order to evolve the railroad project. In the past the Thailand bond market did not progress efficiently because of two reasons. First one, the government didn’t provide any domestic bonds on the years 1987 and 1997 due to budget surpluses. Second one, the law prohibited limited companies from providing debentures prior to the presence of securities and exchange. The most bond contain OTC (over the counter) that means selling and buying via big commercial banks that hinder some institutional investor and small investors from putting investment in the bond due to the lack of the translucence of both quantity and price. To support the Thailand secondary bond development, the Thailand stock market officially launched BEX (Bond Electronic Exchange) on 2003 November. The SET (Stock exchange of Thailand) committee allowed corporate problems and government bonds. The capacity of the bond market in domestic has been grown substantially, mainly by the enlargement of government securities. There was a continuous rise in the private debt securities, beginning from the year 2005.

Government owned financial institutions: The third constituent is SFI (Specialized Financial Institutions) and it contains six government owned SFIs. They have the total asset percentage of 14 during 2008 particularly for Government Housing Bank, Government Savings Bank and Agriculture and Agricultural bank. BAAC cooperative had a prominent role which is due to SFI had been used by the government of Thaksin to bring out the popular policies in lengthening loans for poor, small and medium sized people who are doing business. The BAAC has been established in 1966, which is the main source for farmers. It was enhanced in the rural bank by permitting these loans beyond the farmers.

Non- bank financial Institution: In Thai financial system, this is the final constituent. It has been accounting eleven percent in the total financial sector asset in Thailand in 2008. Life insurance companies taken a major role in constituent and they have been accounted as 5.2 percent in the total asset. Whereas the vital of finance companies was negligible and it has only 0.3% of assets in the year 2008.

Thailand has to improve on certain things:

Even though the financial system of Thai has enhanced through various reform it has certain things to make improvement on them.

- There are lots of regulatory authorities in the financial system of Thailand. Bank of Thailand handles three financial institutions are finance companies, commercial banks and credit foncier.

- Thailand has to concentrate more in the financial sector because it has larger growth, but it still can’t compete with some other foreign counterparts. They have to increase their efficiency in bank service.

- Thailand’s capital market is somewhat small compared to the other countries so they must focus on these things. It will help them to add extra advantages for the country.

- To develop an efficient financial system several steps have to be taken. It will make the Thailand country best in financial service.

Insurance Service provided by the Thailand:

There are sixty nine non- life insurance organization have been registered in Thailand and they are providing a wide range of services. Approaching an insurance agency through the broker or by approaching them directly makes no such difference. But by using broker a person can save time and can obtain better results. Professional brokers normally have some knowledge about the companies which is financially stable and provide better service. Insurance agents can’t provide this information because they don’t have the resources and experience to compare the details with some other insurance company. An Insurance agent can provide only one insurance organization and they cannot give a choice about companies. Premiums and policy benefits are the first factors for choosing the insurance policy because premium and benefits are easily comparable with other companies. Some other features cannot be clear before making any choice. Some other companies provide good and best service and some have a bad record. Along with the service, the financial stability and background of the insurance company will be included in determining the companies. Some of insurance policies in Thailand are mentioned below:

Personal Accident Insurance:

- This insurance gives 24 hour cover in terms of personal loss during an accident.

- The Compensation amount will be paid for injuries, disabilities by accident and death.

- Some insurance directly pay for the hospital during any loss or injury.

- Several accident policies cover up to 500,000 Baht for medical expenses for every accident.

- The cover limits and premium rate depend on the person’s occupational risk level.

Thailand Health Insurance:

- Health insurance gives guarantees that person can receive medical treatment when they are in an unconscious condition or unable to communicate. It will be very helpful in the time of serious ill.

- International plans for the people who are staying in Thailand.

- If a person below 65 ages, Thailand Health Insurance can offer ten different health If a person above at the age 65 they can provide three health insurance companies.

- Choosing an insurance policy for health is not tedious. The steps have to be followed.

-

- Every insurance companies have different plans to choose

- Have to look the document for more information

- For In-patient treatment, health insurance has the cheapest plan.

- In Thailand, treatment for outpatient is inexpensive, but it fully up to the person.

- If you have planned to move to a different country, you must be treated with importance.

- Expensive plans have fewer benefits. You have to pay more, but in return you will get low advantages.

Thailand Travel Insurance:

Every one need travel insurance. An illness or any accident occurring in another country will be disastrous. Some other problem will destroy your holiday. Travel Insurance range is up to five million Bhat. Cover for both outbound and inbound travelers. Travel Insurance in Thailand, which includes temporary insurance for health at the time of any trip. Extra cover in insurance gives more than the thing needed by law. The minimum needed by law can cover the travelers during the accident only.

Thailand automotive Insurance:

In automotive insurance, Third party will cover only the medical expenses and compensation to other person and for vehicle damage. It also involves bail bond when the driver accidentally kills any person or for more injuries to the person. The cover range includes one million per person for vehicle damage, but it will vary depending on the vehicle.

Insurance for Home in Thailand:

- Both renters and homeowners can get this insurance.

- If you rent any house, the home will get destroyed or damaged, you are responsible and answerable to the owner.

- Damages such as Fire, earthquake. Windstorm, landslide, water damage, bushfire etc.

- Electrical injury for appliances

- Temporary accommodation allowance when the house is being repaired.

- Fire insurance alone has 0.15% premium on the house insurance.

Yatch Insurance in Thailand:

- The Policy covers except the following thing

-

- Piracy

- Volcanic eruption, lightning, earthquake

- Theft of boats, vessel and outboard motors etc.,

- Vessel types which can be insured

-

- Speed boats

- Sailing yachts

- Commercial passenger boats

- Motor- sailing yachts

- Power boats

- Secure a person against bodily injured, damages or property damage

- It covers all physical loss

- The types of policies such as compulsory passenger cover, against total loss, comprehensive cover. These are the policy which is included in this insurance.

Company and company Health Insurance policy:

- Twenty four hour service is provided for the employees during accident by company policy.

- Benefits of staff are more than the social security offers.

- For employee death the insurance cover with the range of 1 million Bhat and for medical expenses up to 100,000 Bhat.

- Health benefits are at reduced rates

- Higher benefits with minimal expense for the employees.