Construction sector in Thailand

Thailand is the country, which situated at the mid of the Indochinese peninsula and it is considered as world’s 51st biggest Country. Thailand has taken the 20th place in population, which contains approximately 66 million people. Thailand’s economy is in world’s twentieth place by nominal GDP & this country became the newly industrialized country. Agriculture, construction, tourism, and manufacturing are the leading sectors in the Thai economy. Asia continues as world’s fastest growing part and the building & construction sector has the greatest impact on its future growth. Thailand is having the yearly output of nearly 50 million cement tons. Although mega construction projects are presently initiated by the Thailand government is the great opportunities for many private investors because of the new construction projects. Even though Thailand construction market growth expectation by construction type activity, project type, and sector, the Thai construction sector will be very busy during 2017 and the construction share spending in Thailand are approximately estimated as 50 percent infrastructure, 30 percent residential and 20 percent non-residential. In which, the residential sector is considered as the fastest growing part and certainly infrastructure will be more profitable in 2017.

.

Thailand’s infrastructure project updates:

1) MRT projects: There are 3 MRT projects and its official bidding along with winning bidders announcement dates are announced as follows:

MRT orange line: This project links with Thailand cultural center in Minburi that began with a submission process in 2016 3rd October. There are only 2 Thai contractors such as ITD and CK are in record tracks who works underground projects well and they are having good chances to get at least one contract. The combination of STEC and CK construction agency having the positive views in the project MRT orange line. Both of their combination will result in a higher market share. By this way, both of them secure higher proportion in MRT orange line projects.

2) Double track railway: There are two projects involved in this and both projects were awarded to STEC and CK. This construction provides positive phase in profit for the year 2017 for CK and STEC.

3) High-speed railway: The government conducting the feasibility research on first two schemes of PPP for high-speed projects for railway including Bangkok. The government expects to see some relevant progress on November 2016 in these two projects.

4) Motorway projects: The contracts for motorway projects had been awarded to the several contractors, which given the simplicity of the civil project.

5) Airport expansion projects: Thailand Airport kicked off for the bidding process to first two contracts regarding Suvarnabhumi Airport Phase.

6) Thailand Govt. approves $2.6bn Rail Project: Thailand’s cabinet has given his consent to a $2.64 billion plan to build a new prominent rail line in the overcrowded capital, as the government seeks to shift its pace on $50 billion of big-ticket infrastructure projects to enhance the economy.

The Thai government is setting up to rapid up on infrastructure projects for next year, particularly for Bangkok rail.

7) Construction of New Shopping Malls/Centers in Phuket: In the next few years, the shopping industry in Phuket will significantly expand its limits with the construction of new entertainment and shopping malls/centers. These complexes propose the latest understanding and a widespread approach to the mixture of leisure and shopping.

Escalating attention is being provided to the entertainment media and to places of leisure. In addition to the previously known cinemas and beauty salons in the environs of the shopping malls/centers, the new construction projects will comprise their own exhibition spaces, aquariums, walking parks, playgrounds and resorts designed to participate in a global scale.

A good number of public and private investments are involved in this new shopping infrastructure.

The following projects are currently in the works:

BluePearl

This commercial complex, mall, convention center, bazaar, and resort project is to be constructed on 240,000 sq. m. of land at Kathu. The project, which is approximated at 20 billion baht, is supposed to be open in 2017.

Bukis

A distinguishing feature of this shopping arcade/center is street style stalls in an open area of the mall, showing the Thai shopping culture. The project budgeted at 400 million baht and is to be open in this year.

Central Retail Complex Expansion

The extension of the Central Festival shopping mall consists three stages of construction. The first stage will include renovation of the existing complex. The next stage will be dedicated to the building of the largest aquarium in Asia and botanical gardens. The contention is to compete with Singapore. In the last stage, there will be the construction of 5 stars rated hotels of international standard and an exhibition center. The cost of the project estimated at 10 billion baht.

Duty-Free Retail Complex

This two stories duty-free retail arcade/complex will be built on approx 20,000 sq. m. of land in Kathu. The project is a budget at 1 billion baht and is expected to be open in 2016.

Gross domestic product in Thailand:

Thailand’s GDP is an essential measure for estimating the Thailand’s economy performance. Thailand’s National Economic office & Social Development Board publish Gross Domestic Product sho

ws on the quarterly basis. The below table mentions the change cost adjusted GDP of Thailand and it can be typically referred as the economic growth rate of Thailand.

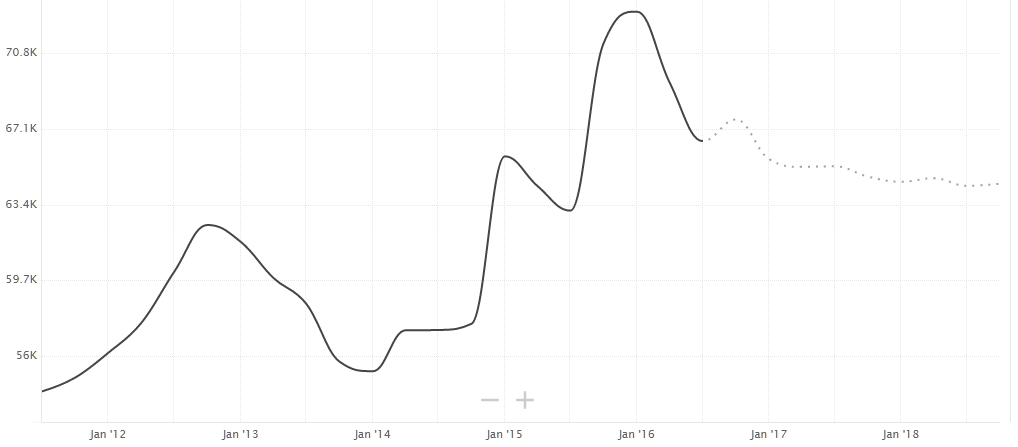

Thailand GDP Chart

GDP growth performance in Thailand:

Ten years before, Thailand GDP grew with an average percentage of 4.7% and in 2009; the Thailand economy had a contraction of 2.3% that was a big GDP drop in the twelve years. Then, the economy goes up & downs, later in 2010, the economy grew up to 7.8 percent, it’s mainly because of the export volume increase. The economy had expanded to 0.1 percent in 2011 and the important slowdown had occurred due to a severe flood on 2011 monsoon. Thailand GDP elaborated 3.2% from the 3rd quarter of 2016, the private consumption; exports and investment are the main growth drivers when government spending declined quickly. For 2016, NESDB is the economic planning agency for Thailand projected the economic factor to advance 3.3%, compared to the previous forecast range such as 3 to 3.5%. Later, it was increased to 0.6% compared to the downward revision of 0.7 percent expansion in previous 3 months. On 2015, second quarter, the growth rate was decreased below the market consensus of 0.7% expansion. In Thailand, the annual growth rate averaged 3.69% from 1994 to 2016.

GDP growth performance

GDP Annual Growth Rate for Thailand

Thailand GDP, construction was reduced to 66489 Million in a 2016 third quarter from 2016 second quarter 69325. At 1996, the first quarter gross domestic product reached 103692 THB Million and it was low in the fourth quarter, 2000 as 36619 THB million.

GDP (Thailand) from construction

GDP (Thailand) from construction forecast

Thailand infrastructures & civil construction in 2016:

Thailand construction industry registered the solid annual growth of 6.03% at the time of 2009 to 2013. Behind Thailand proposed by ASEAN in 2015, the construction market has been expected to grow up to 3.19% and some other independent professional organization forecast 9.15% CAGR. In 2015, Thailand construction sector increased up to 15.8 percent and essential enhancement over 0.1 percent in 2013 and 3.7 percent in 2014, and then the industry contributed to 2.8 percent GDP. Projects for residential accounted 66 percent in total area construction permitted in 2015 when the industrial projects created up to 16 percent total. The continued economic expansion, increasing housing demand and levels of renewed government investment in public infrastructure are projected as the important drivers of growth. Thai Government allocated around $100 billion for ongoing infrastructure development for the year 2014 to 2021. Thailand’s construction industry can be expected to raise the value to $19.9 billion in 2019 becoming the 2nd largest market. Presently civil construction and infrastructure sector are experiencing the solid growth in the country of Thailand.

Two main reasons explaining this tendency, the first one is the hospitality and tourism sector significant in Thailand economy. Tourism makes 10% GDP contribution and its forecast mentioned about increase up to 4496.7 THB billion by 2025. The Thai government requires modernizing the country’s key infrastructure such as motorways, ports, and airports to adopt the perfect handling in tourism growth in Thailand. The second one is government need to set up in 2014 May to consolidate the modernization policy towards the country. The Thai Government has signed nearly 20 mega projects and expects on September 2016 about civil construction and infrastructure. Thai commitment in civil and infrastructure works guarantee the country’s economic growth up to 3% in 2016. The rapid economic growth & limited budget are the two key reasons that why public sectors strategically implementing a private participation in the development of infrastructure and services. Industrial construction projects have varied over the year and it contains the result of sample size smaller within a subsector consisting of lesser, but very huge projects. Lastly, the commercial property, construction rebounded to 3.75 so meters of the construction area in the year 2015 after the consecutive declines during the previous years such as 28.4 percent and 17.8 percent. Although the economic diversification, rose trade and thriving tourism industry are the driving growth of Bangkok city remains the leading construction market within Thailand and it was estimated at 60 percent of all allowed construction activities in the year 2015. According to reports from BOT, total 12.4m square meters allowed construction space within a Bangkok metropolitan area had been on the 2015 books, down from 13.8 square meters in the year 2013 still far higher than another region. Construction areas in a central region not including the Bangkok total estimated at 2.27 square meters, while the other regions combined estimated for 5.07 square meters of the permitted area.

Future growth of Thailand Construction is looking good:

In older days, construction of Thailand was slowing face of regional economic growth and it was slightly enhanced in the year 2015. However, risks associate in the industry’s positive outlook still in place. An economic and its structural factors combined with the absence of modern transport, structure and the lack of skilled workers will likely slow down potential industry growth. Highly focusing on Bangkok and their surrounding places in 2015, Central business district of Bangkok and other incoming producing properties having strong along with some high-value properties can be provided for sale. In the year 2014, annual reports mentioned that Central Region that includes Bangkok and surrounding places are accounted for the 63.2 percent of the whole land and building transactions, which provided by BOT data. This flow also continued in 2015, with a central region, accounting nearly 62% transactions in the 3rd quarter. At 2014, the real estate concentration deals held in Eastern Region estimated at 12 percent total, in Noth- Eastern region estimated as 9%, the Northern region estimated as 8.4% and Southern region estimated as 7.4%. Looking outside of the Key central region, the industrial expansion led the sustained growth in a traditional industrial park and also in new place bordering on the neighboring countries to the north. This economic along with industrial growth had the ripple effect on the other localizes real estate in the retail, residential and commercial segments. And also transport infrastructure extension and raising purchasing Thailand’s power in growing middle class can get a new chance in the suburban markets and also in other pockets in the city.

Thailand infrastructure report for 2016:

Huge public infrastructure projects, particularly in transport & energy sectors are the key drivers for the growth of Thailand’s construction industry. Meanwhile, tourist arrivals along with favorable economic environment sustain the positive trends in residential and nonresidential construction. Latest updates & structural trends are as follows:

- Supported by the huge public investment, growth & favorable interest rates in Thailand construction sector remain noticeable over the term and its expanding 5.5 percent in 2016 and 3.3 percent in 2017.

- According to the Thai National Economic & Social Development Board, construction sector, particularly the public segment provided robust growth for the year Q2016 and the sector had been expanded up to 7.5 percent with the public construction by increasing 15.5 percent and private construction sector declined by 2.1 percent in value terms.

- Thailand construction sector will get advantage from heightened private investment in a rail sector. The government recently awarded the Red line contract project and also approved two Bangkok railway projects & put 2 high-speed railway projects in the PPP fast track plan; these will act as major growth for the Thailand country.

- In 2016 June, Airport of Thailand revealed the plans of spending THB194bn for the next fifteen years in order to expand the airports. The total scheme cost has inflated from previous plan THB140bn, largely because of the revision in expansion at Bangkok’s Don International Airport.

Delays are normal, but avoidable:

In Thailand, even huge construction projects are typically based on merely cursorily documentation & insufficient terms definition and conditions. Tenders and competitions procedures are poorly arranged, prepared and managed. Lack of knowledge, construction laws ignorance and industry practice will go to look for the silly shortcuts & unlawful circumvention of laws and regulations. These and all provide a situation for the investor prepared to fight against delays, poor quality design, cost increases and construction practice.

Legal Service scope:

Support & assistance for the legal aspects of tender documents for the architectural & construction contracts are explained as follows:

- Legal assistance for public and private building & construction law & architects law in Thailand. Contract management involves design, negotiation, and preparation of Thailand construction contracts & supportive documents including the change order management.

- Claim & anti- claim management: Defense of performance, warranty, enforcement, remediation, deficiency, payment claims and liability. Construction related legal factor in pre-construction phase along with the construction course project such as pre-trial discovery, preservation of evidence, arbitration in construction, negotiation, architectural & legal distribution disputes.

New space for establishment:

When Thai government began to invest in infrastructure projects will open the new property, land organization in order to develop the residential projects. This thing will challenge the property organization to invest in a new location following the mass transit route such as from Bangkok to suburbs and nearby provinces. The massive infrastructure outlays can be designed to make sure the Thailand status as the ASEAN economic transport hub and it will include ten new mass transit routes for rail, in addition with double tracking railways and constructing new motorways. It was initially reaffirmed in the year 2012, while the Thailand Rapid Transit Authority announced plans to build 6 additional lines for the Bangkok’s existing urban railway. These new lines can be expected to cover the combined distance at least 200 Km and will need the cumulative investment of BT600bn by 2020. The Thailand government backed a plan further in the year 2013 when it was committed BT470bn of the government infrastructure spending plan for the Bangkok’s urban railway development. Particularly, the targeted expenditure is on the Yellow, Purple, Orange, Pink, Green, and Blue, Red as well as the airport expansion rail link.

Key trends & opportunities for 2018:

The following description explains about the detailed market analysis, insights, and information in the Thai construction sector including:

- The growth of Thailand construction industry prospects by market, construction activity type and project type.

- Analysis of material, service, and equipment costs across every project type in Thailand.

- Critical insight into the impact of industry issues and trends, and opportunities and risks they are present to the participants in the Thailand construction industry.

- Profiles of leading operators in Thai construction industry.

- Data highlights of projects of the largest construction in Thailand

The real estate investment introduction also assisted in stimulating the Thailand construction activities. Political & social uncertainties can be expected to lead moderate growth rates for the period 2014 to 2018. The construction sector output is expected to reach the rate of 3.19%, which can be supported by a government investment in infrastructure development. Political protests in the city, Bangkok, began at 2013 end and continued to the 1st quarter of 2014, these had the negative impact on the Thailand construction industry. According to a Ministry of Energy, the country’s demand for energy is projected to rise from 160.705 growth in 2011, expecting 246.16 in 2020 and 346.7 percent in 2030. In order to maintain the balance in-between demand and supply, the government approved the Thailand power plan development 2010 to 2030 in 2011. It also requires to match the generation capacity with increasing demand is expected for to support energy growth infrastructure for the forecast period. Thailand country invests heavily in rail infrastructure development and launched many mass transit routes. Projects are presently under construction like Sukhumvit line extension that includes the Green Line expansion from the place MoChit to KhuKhot.

Conclusion:

Continued economic growth along with Bangkok’s attractiveness for foreign business & individuals must sustain demand in a property going forward even for the new stock across every sub-sector to hit the market in upcoming years. Organic demands in the residential property can also be stimulated in the short term as the result of efforts by the government. Within Bangkok, real estate value to the retail, residential segments, an office within CBD must remain robust because of the restricted supply, which means only limited vendors can able to sell the land in most exclusive areas, leading to savage competition. Strong demand for the property along existing one and a planned mass transit path will likewise increase the property value with these corridors. The handful of new and large projects can bring the new stock in the market for next three years. Demand for space in the office as the whole expecting to remain strong in the part of Bangkok’s reputation among the foreign investors looking forward to extending their investments in other ASEAN countries.