Thailand’s Import and Export Sector Gained Huge Success In The World Marketing

A South East Asian country called Thailand, is well famous for its shorelines, rich royal residences, antiquated sanctuaries furthermore for some religious convictions. Thailand is the world’s 51st-biggest nation. It is the twentieth most crowded nation on the planet, with around 66 million individuals. The capital and biggest city are Bangkok. Thailand is a protected government and was a parliamentary popular government until the overthrow in May 2014 by the National Council for Peace and Order. Its capital and the most crowded city are Bangkok. It is flanked to the north by Myanmar and Laos, to the east by Laos and Cambodia, towards the south by the Gulf of Thailand and Malaysia, and toward the west by the the the Andaman Sea and the southern furthest point of Myanmar. Its oceanic limits incorporate Vietnam in the Gulf of Thailand toward the southeast, and Indonesia and India on the Andaman Sea toward the southwest. The Thai economy is the world’s twentieth biggest by ostensible GDP and the 27th biggest by GDP at PPP. It turned into a recently industrialized nation and a noteworthy exporter in the 1990s. Assembling, horticulture, and tourism are driving areas of the economy. It is viewed as a center force in the locale and around the globe.

The Initial Attempt Of Thailand To Set Records:

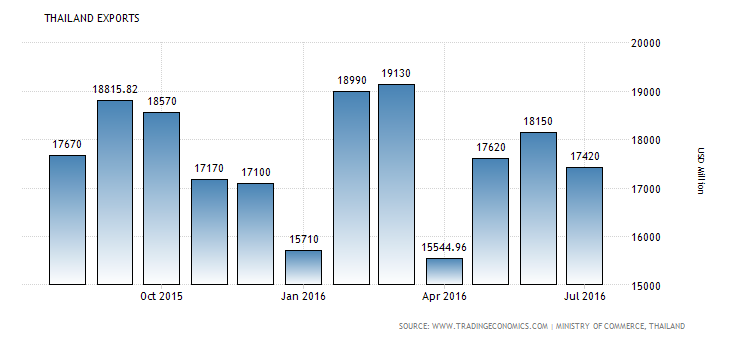

The nation has now landed its feet in all phases to accomplish an awesome conservative development and advancement. The aggregate fair estimation of Thailand in 2014 is added up to 214.38 billion as far as US Dollars. Be that as it may, the value is 5.78% lesser than the fares sum at 227.57 billion in past reports. The significant results of Thailand’s business area are the automotive trades, PC exports, rubber fares and modern fabricated merchandise. In both import and export, China has turned into a vital exchanging accomplice for Thailand. The US and Asia are the principle goals of Thailand exports. Thailand likewise has positioned itself high among the automotive export enterprises and hardware merchandise makers around the globe. Thailand export is considered as one of the biggest on the planet as far as agrarian items, such as shrimps, rice, sugar, custard, and rubber.

Thailand Import And Export Segment Situations:

The critical imports of Thailand likewise incorporate gold and silver. Bangkok and Thailand go for enhancing their gold deals market around the world, however, unfortunately, Thailand’s gold generation is exceptionally restricted.

POPULAR INDICATORS 2016

| Import (US$ Thousand) | 202,019,428.04 |

| Export (US$ Thousand) | 210,883,382.47 |

| AHS Weighted Average (%) | 3.36 |

| Country Growth (%) | -9.68 |

| GNI per capita, Atlas method (current US$) | 5,620 |

| MFN Weighted Average (%) | 6.27 |

| Service exports (BoP, current US$) | 61,076,978,745 |

| Service imports (BoP, current US$) | 50,958,617,429 |

The rundown of import business proceeds in different structures, for example, household appliances and mechanical merchandise like iron, hardware, chemicals, steel, and PC. Indeed, even with the notable medical tourism industry in its area, yet, Thailand has a minor commitment in the field of pharmaceutical. At the point when talking about the export segment in Thailand, automotive is the principal export in Thailand, which additionally incorporates accessories and parts.

|

|||||||||||||||||||||||||||||||||||||||||||||

Among the most noteworthy auto-creating countries everywhere throughout the world, Thailand holds the 12th rank. Chemical items and PC related items are another significant fare item. Next, comes the rubber export and Thailand is the primary rubber creation country when contrasted with alternate nations. Instead of industrially fabricated merchandise, nourishment items, fare such rice, custard and fish likewise hold the critical spot.

Thailand economy is a developing economy:

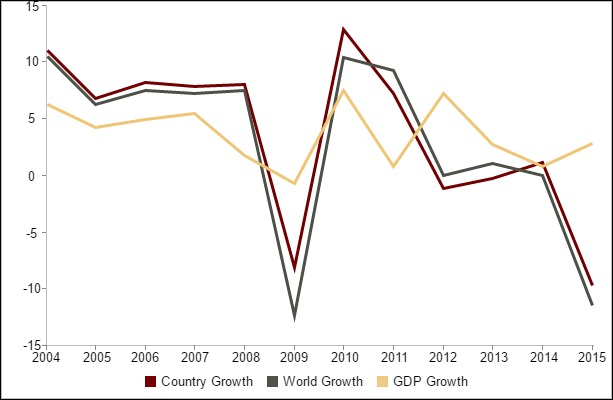

Thailand economy started to recoup from the year 1999 because of its expansive exports. In 2001, the monetary development has ended up 2.2 % and they have expanded spending on household, to have numerous super undertakings. In the midst of the years 2002, 2003, 2004 the financial development got improved around 5 to 7%.

In addition, Thailand is the second biggest economy in southeast Asia. It ranks in the mid of southeast Asia after Brunei, Malaysia, and Singapore. Regarding external trade, Thailand nation ranks second simply behind Singapore. In HDI (Human Development Index) it holds the 89th position and the national destitution line has been diminished to 13.15 % from 65.26 rates in 2011. In 2014, Thailand unemployment is lessened in light of the fact that a great many people began working in the agricultural field.

e-customs in Thailand:

Thai customs use the PC methods to give an extensive variety of backings in numerous traditions operations. “E-customs” was presented on January first, 2007, including e-export, e-import, e-payment, e-warehouse and e-manifest. It gives business administrators like imports, exports, shipping organizations and traditions agents. The e-custom is the complete framework made by Thai traditions to prepare and encourage all business imported merchandise into Thailand. It is considered as the most incorporated and advanced business-oriented frameworks. The e-custom system, for the most part, decreases expenses and printed material necessities for traditions and significant exchanging office. In the event that a man needs to interface with e-custom frameworks, then he has to enroll with custom enlistment and custom sub-Divison and custom strategies and valuation standard bureau. The qualified individual must be business administrators, as indicated by the customs such as:

- A person processing formalities with customs

- Passenger responsible for loading cargo

- Representatives who provide outbound and inbound vehicle report

- A Service counter

- A Customs bank

A Digital certificate, it is a signature in electronic of either a person or related entity. The digital certificates stay as software file and it will be placed on web- browser. It creates a distinctive identifier which can be verified by the receiver to give evidence of sender identity and to confirm the documents which are not altered or forged. Basically, these digital certificates have two separate parts with private and public keys. First one is for signing and a second one is for encrypting or decrypting electronic messages. The digital certificate is needed by any traveler who wants to coordinate with e-customs systems.

How to connect e-custom systems:

The business operator should decide which method has to use to coordinate with customs. The customs involve two methods of communication. They are direct communication and indirect communication.

Direct Communication: Some arrangements have to do with the business operator in order to coordinate with Thai customs with own digital certificates.

- Installation of software, choosing the service provider, digital certificate and business operator in direct communication, among that you should be very careful with digital certificates is installed correctly before using e-customs system.

- Have to register with customs of Thai

- Test the readiness of message and accuracy with customs system

- If the test is finished, the Information Technology Bureau will provide a registration ID for the business operator. It can be used in the future with e-customs system in online communication.

Indirect Communication: If a person doesn’t want direct communication with Thai customs, is allowed to utilize the service given by either a service counter or customs broker. The business operator has decided to connect to e-customs by using a broker, a person must sign their digital certificates or broker have to sign on behalf of respective people. If a person is chosen by service counter, the business operator needed to give goods document service counter invoice. Then the service counter submits the information to e-customs system.

Import procedure for Thailand:

If a shipment arrives in the Thailand, importers are needed to file a declaration for goods and supporting documents with a customs officer in the entry port. Imported cargo won’t enter legally in the Thailand till the shipment arrives at the port of entry. Delivery of the goods to be bought and sold will be permitted by the customs and duties and applicable taxes have been paid. The importer responsibility is to arrange for examination, then imported cargo release. The importers need to get clearance of the imports permits for some goods, not for all goods. In the case of high-risk shipment (red line), few documents required, which must be submitted for clearance of imports to the customs. Documents such as Certificate of origin, import declaration, bill of lading, invoice, packing list, product ingredients, catalog etc., The next process is Declaration and clearance process, in this process, relevant parties are no need to submit all data electronically from importer system to e-customs system. The Declaration and clearance involve four steps such as:

- Declaration submission: This is the first stage to finish import declaration and submit the documents to e-custom system. Initializing with the arrival of cargo or before the arrival of cargo, the aircraft arrival report must be submitted to e-customs system electronically by the shipping agent. In this report, it should be free from errors, because the response will be automatically generated to shipping agent by e-customs system. Customer or broker has to provide an import declaration when the cargo arrives.

- Verification and checking process of the declaration: This is the second stage, in which every supporting document must have done by an importer. The e-customs system again check the given data and payment numbers with the e-payment. The selective system will verify the data which have been transmitted and can be highlighted by a red line or green line.

- Taxes and import duties: This is the third stage, in which two options are available for the payment. One is payment through e-payment system and the other is payment of the department of customs.

Release of Automotive and inspection:

The final stage that to make inspection and to release Automotive from the custody. At this stage, the exporter has electronically sent the Automotive report to e-customs system. This system verifies the data, and if any error occurs it will be immediately corrected in online. If no error, the main head of Automotive will report the number which is automatically produced by the system and the message will be sent to the broker or export. Then the exporter has to take print out of the report with its number. At last, it will dispatch to the exit port, when the officer at the customs sub gate will check the declaration that was given is a green line or red line. If the report is the green line, the document will be cleared within a minute and the shipping agent should submit the open information to e-custom system. After that, response messages will be automatically received by the exporter or broker for the next case. In this, Automotive export will be moved for physical inspection to find the goods are on the red line.

Buy what you need once you arrive in Thailand:

If a traveler or a passenger stopped by customs officers for a deeper inspection, it doesn’t mean the traveler is caught for any wrong activities. Thai customs prosecute undergone many laws for agencies. If any passenger is bringing any product more than 10,000 Baht, such items will come under import duties and taxes. The dutiable items are given:

- The dutiable items are proposed for personal use

- They are in reasonable quantity and it doesn’t have intended for trade purposes, business or commercial use.

- The total value should not more than 80,000 Baht and travelers must pay the duties and taxes in cash.

Regarding Products, the quantity exceeds more than 10,000 Bhat are subjected to pay taxes and duties. Travelers have to contact the Inspection sub- Division in order to check the duties and payment of taxes. When the dutiable items crossed more than 80,000 Bhat, those items are sent to import customs. The goods are placed under customs control till the formalities have been finished in the customs formalities subdivision by the travelers.

Why ATA Automotive news?

A.T.A Automotive grants the permanent import of advertising materials and exhibition, scientific equipment, and commercial samples. The usage of Automotive is observed and it utilizes the temporary importation with fewer restrictions are maintained without any payment of duty. If the traveler has A.T.A Automotive net in Thailand, they must contact customs officers to the Red channel. Clearance of goods and customs formalities under A.T.A Automotive will be processed and finished at the airport. A.T.A Automotive traveler needs to finish a re-exportation form and it contains a Re- exportation voucher and Re-exportation counterfoil. This will provide them along with the re-exported items to the customs officer for verification. The re-exportation counterfoil has to retain the Automotive holder during the re-exportation voucher and have been retained by the officer in customs. Automotive also used to get for temporary duty or tax-free export from Thailand to other foreign countries. For application details, they can contact International Chamber.

Departing from Thailand:

If anyone departing Thailand with costly items like laptop, PC, tape recorder, video cameras, cameras, etc. they have to register these items to customs at airport departure behind checking of the boarding pass. The customs officer will collect the export of personal items for re-importation. Registered item will be allowed in the duty-free entry when they return to Thailand. In terms of jewelry, outbound travelers have to finish the customs formalities prior to their departure in the customs Airport office. If any goods under the tax Drawback scheme, outbound traveler have to provide “Re-importation certificates ” to complete the formalities in the customs airport office. It will be legal to send or take out of Thailand prohibited or restricted items, for example, faked noted, faked coins, pornography, obscene items and drugs etc. custom will catch the prohibited items. If any outbound travelers lead this type of crime they will subject to imprisonment and fine. In terms of foreign currency, the traveler has to inform the customs if they are bringing currency higher than USD 20,000 or its proportional amount in and out of Thailand country. This report is needed by Ministerial regulation. The notification and regulation want that the outbound travelers bringing the exceeding USD 20,000 or above must be reported to the customs officer at the airport by utilizing the foreign currency form. If Thai currency is more than 50,000 Baht it should be informed in departure, expect who is traveling to Cambodia, Malaysia, Myanmar, and Vietnam. These country people are allowed to carry the money, but it should not exceed 500,000 Baht.

Impact on Thailand Economy because of Import and Export Sector:

Thailand is a newly industrialized country. The country’s economy mainly depends on export with the range of more than 2/3rd of its domestic product. This economy grew up to 6.5 percent with the inflation rate of three percent and they expected to grow 3.8 to 4.3 percent in the economy. Around 2013, its economy reaches to 4.1 percent. The service and industrial sectors are the most important sectors in Thailand gross domestic product. The mining and construction sectors add 9.8 and 13.4 percent respectively. Other sectors such as education, restaurant, and hotel sectors are improved to twenty-four percent. The present economy is increasing in all sectors and they are mainly concentrating on imports and exports to enhance their country wealth.