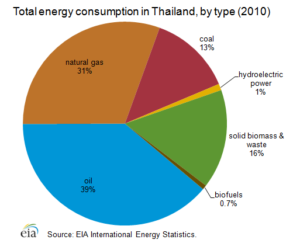

Oil and gas are the most important resources in Thailand. In Thailand, Rayong province is located quite close to Thailand’s offshore gas reservoirs. Thus, it gives rise to the major gas consuming centers in Bangkok. Now this led to the Thailand’s three major offshore gas pipelines that are being constructed through the region. Relatively, as a result, the province, and especially the Map Ta Phut industry, has grown into one of Thailand’s largest petrochemicals centers. In the 1980s construction work began on gas separation plants for producing fuels that could replace crude oil imports.

The industry is mainly divided into three major components: upstream, midstream and downstream. Midstream operations are generally included in downstream operations.

- Upstream: The upstream sector involves searching for underground or underwater crude oil and natural gas spots, drilling wells for the exploratory purpose, and afterward drilling and operating the wells that bring the crude oil and natural gas to the surface.

- Midstream: The midstream sector includes the transportation of oils by means of a pipeline, rail, barge, oil tanker or truck. The midstream operations often include some elements of the upstream and downstream sectors.

- Downstream: The downstream sector not only involves the refining, processing and purifying of crude oil and natural gas but also marketing and distributing of products derived. Products such as gasoline or petrol, kerosene, jet fuel, diesel oil, heating oil, fuel oils, lubricants, waxes, asphalt, natural gas, and liquefied petroleum gas and other hundreds of petrochemicals reach consumers through the downstream sector.

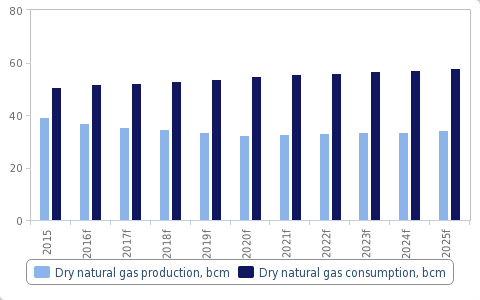

Industry Trend Analysis of LNG:

Now let us see the output and expansion growth of natural gas in December 2016.Thailand’s natural gas imports have increased over the coming 10 years because of falling production and LNG import capacity expansion. Natural gas production in Thailand is assumed to fall by 8.8 percent between 2016 and 2025, because of the low oil prices, poor investments in new assets and growing fields weigh on output. This will be in clash with steady growth in Thailand’s consumption of natural gas which will increase at an average rate of 1.0-2.0 percent per annum over the next 10 years.

As domestic production complains insufficient to meet rising demand it will become necessary for gas imports to reimburse for the rising needs. Thailand depends on pipeline gas imports from Myanmar for more than 60.0 percent of total gas imports.

Natural gas production and consumption

Impact on GDP of oil and gas industry in Thailand:

Thailand is a middle-income country with GDP in 2013 estimated at the US $9,900. Low-cost domestic supplies of oil and gas have played an important role in the country’s economic and social development. Established reserves of oil and natural gas have peaked, oil in the year 2004 and natural gas in the year 2006. However, Thailand relies on imports of both oil and natural gas to meet its needs. The country experienced more than a few years of slow growth because of internal political turmoil, natural disaster in 2011 and also due to the global recession. This became the immediate challenge to secure energy. Since 2008 there has been no new licensing round which was initially next set for 2013.

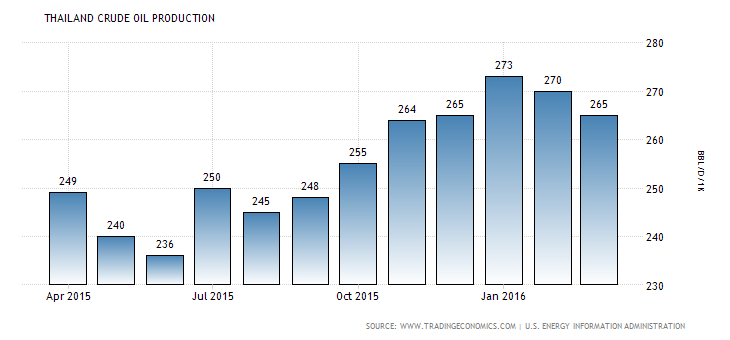

Such investment is needed to discover and develop new resources to boost reserves, maintain production and limit the need for imports. Access to potential resources is also restricted due to Thailand’s border dispute with neighboring Cambodia. The neighboring country, Cambodia compete for claims over their maritime border in the Gulf of Thailand. This area connects Thailand’s offshore oil and gas producing fields making it highly potential. Thai oil production has risen in the last few years as about 80 percent of the country’s crude oil production is produced from offshore fields. Chevron is considered as the largest oil producer in Thailand.

Nearly 70 percent of the country’s crude oil and condensate was produced in 2011. The largest oilfield is Chevron’s Benjamas that is located in the north Pattani Trough. The field’s production reached a high position in 2006 and was put down in 2010. Now Chevron is developing some satellite fields to sustain production around Benjamas. PTT public company limited is another important crude oil producer supplying 22,000 barrels per day of oil in 2010. Small independent companies like Salamander Energy and Coastal Energy began exploring onshore water fields including Bualuang, Songkhla, and Bua Ban that came in during the year 2009.

Economic interest:

Thailand oil reserves produced 453 million barrels in January 2013, which is a significant increase of 11 million barrels from the previous year. According to a study in 2011, Thailand produced total oil liquids of about 393,000 barrels per day of which crude oil was 140,000 barrels per day, 84,000 barrels per day was condensate, natural gas liquids was 154,000 barrels per day. Thailand used up to an expected 1 million barrels per day amount of oil in 2011, leaving total net imports of 627,000 barrels per day, thus making Thailand the second largest oil and gas importer in Asia.

Crude oil production analysis:

Crude oil production analysis:

Thailand’s largest commercial oil industry:

The Map Ta Phut Industrial Estate is one of the world’s biggest petrochemical hubs. Map Ta Phut is a town in Rayong province. In entire Thailand’s Provincial offices is located in Map Ta Phut. Approximately 70 percent of the crude reserves and almost all of the condensate reserves are located in Thailand’s offshore waters. According to the sources in 2011, the recoverable reserves were 60 million tons, production was up to 10.4 tons per year and production ratio was 8 years. Thailand’s expenditure on petroleum imports decreased from 15.4 percent of the gross domestic product in 2004 to 10 percent in 2008.

List of largest petroleum companies in Thailand:

- PTT is one of the largest corporations in the country and also the only company from Thailand listed in Fortune Global 500 companies. PTT accomplished its first 4bn cubic meter gas separation company in Rayong province in 1984. in the period of the second world crisis of petroleum shortages in order to provide as feedstock for nearby petrochemicals plants and liquefied petroleum gas for households.

- PTT Exploration and Production Public Company Limited is an oil and natural gas exploration and production company which is based in Thailand. It is a subordinate of the PTT Public Company Limited. This company was founded on 20 June 1985 and is operating in eleven other countries worldwide.

- Thai oil: Thai Oil Public Company Limited or simply Thai Oil is a Thai public company. It is listed on the Stock Exchange of Thailand. The company was established on 3 August 1961 as Oil Refinery industry. This company is one of the largest oil and natural gas exploration and production companies in Thailand.

- IRPC: This industry was previously known as Thai Petrochemical Industry Public Company Limited and was founded in 1978. This company is in Mueang Rayong District, Rayong Province, Thailand.

Flow of foreign investments:

These industries have a great interest in the foreign business. Thailand has been always open to foreign investment in its oil and gas sector. Today, there is a mingling of large and small sovereign foreign companies working in Thailand. These include Chevron (US), Total (France), BG Group (UK) and Salamander (UK). Previously BP, Shell, and Premier have also been active in the country. Most foreign operators active in Thailand will be thankful to report their tax payments in Thailand.

Strategy of oil and gas in 2016:

Facing turbulence and complexity, energy executives need a plan that takes advantage of current conditions. Actions that are taken by industrialized nations to lessen global warming by limiting the use of fossil fuels got a momentum in June 2015. The owners of the G7 industrialized nations issued a report to remove petroleum-based energy by the end of the century. Six months after these 200 nations at the COP21 summit in Paris agreed to aim the limiting of global temperature to less than two degrees Celsius and to reach zero greenhouse gasses that will emit due to the burning of fuels in the second half of the century. This deal appears to represent a collective commitment by large and small nations to stop fossil fuel production and consumption. This meeting was anticipated by the CEOs of 10 of the world’s largest oil and gas companies (BG Group, BP, ENI, Pemex, Reliance Industries, Repsol, Saudi Aramco, Shell, Statoil, and Total) from declaring their support. For which they were gathered and aimed for COP21 targets the previous month before the Paris meeting.

As we enter the second year of low prices, every company in the oil and gas industry will be challenged in a different way. The owners will have to attend the occasion, repositioning themselves based on what they do well today as well as on the opportunities they are going to see forward. The skill at managing the new business at these conditions, the industry will disappear but it will certainly look different 10 years from now. Some strategies for success have left their mark thus others will be surprising even to the companies that offer them jobs for the improvements.

Trends and opportunities:

Thailand’s oil and gas industry is well known and was established back in the 1970s and is known for its widespread exploration. Commercial discoveries were made by international companies in the 1980s. Thailand has already conducted 20 petroleum businesses bidding round thus making its sector one of the most progressive and relative to other nations in the country.

Thailand is in the process of expanding and acquiring new supplies in the realization that the current usage demands more up-to-date supply of oil and gas in the market. Challenges are indefensible and to an extent that it leaves Thailand in danger.

As discussed earlier the current key challenges for the industry involves the21st domestic gas concession. Future operations by existing operators for two major fields, Erawan and Bongkot that account for 76 percent of total domestic fuel production in the Thailand are decreasing its supply due to the interruptions from Myanmar.

The oil and gas demand in 2016 is predictable to slightly increase at one per cent up from the previous year 2015 with a rate of about 4.8 billion cubic feet/day to five billion cubic feet/day. This growth is mainly from the industrial division and is expected to increase two percent per year over the next five years.

Tumbling oil and gas prices have made upstream activities quite stable. To overcome the oil and gas source challenges and improve the energy security in Thailand, the government and PTT Public Company Limited have moved their interest in building gas infrastructure.

Opportunities

Infrastructure is a growth area with major projects that involves a combination of east-west gas connection line and natural gas receiving terminals. Investment in the assets like pipelines are achieving great interest because it reduces the cost of steel as plastic makes investment expenditures much lower than previously planned infrastructure. A large scale east-west connection line and other related connected transmission lines projects are presently under Environmental Impact Assessment study before the construction proceeds. A number of good investments in oil and gas fields near Thailand are being discovered by PTT Company to supply for the consumption of domestic gas and for the future liquefied natural gas exporting businesses.

Floating Storage and Regasification Units in the Gulf of Thailand, Myanmar, and the southern part of Thailand are also under concern. Neutralizing of low performing and unviable areas is an emerging platform of opportunity for Australian exporters of which there is little capacity in Thailand to deliver their product. For instance, Chevron which is the largest upstream operator in Thailand is estimated to initiate decommissioning stages in early 2017.

In an effort to maximize benefits of the currently low global liquefied natural gas prices and to secure the oil and gas supply, PTT plans to secure in more long-term liquefied natural gas purchase agreements and is currently dealing with a number of suppliers. The companies who are in liquefied natural gas supply chains and supply innovate gas pipeline technology or have expertise in decommissioning either in consultancy field or in establishing the field, the presence in the market will have an advantage from the current market direction in Thailand.