Thailand is one of the largest economically stable countries in South Asia. The capital city of Bangkok is a social hub of Thailand with a booming retail industry market. Not only Thai residents, it has also fascinated many multinational retail companies to make investments in the country. Its retail market is evolving swiftly to meet the demands of the consumers’ varying lifestyles who are greatly motivated by the internet today. The economy of Thailand is greatly dependent on its exports that account for approximately two-thirds of its GDP.

According to sources, Thailand observed a GDP of 11.4 trillion baht ($366 billion) in 2012. As a result, the Thai economy was raised by 6.5% having an inflation rate of 3.02% and an account surplus of 0.7% of the total GDP. The economy was expected to amplify up to 4.3% during 2013. Apparently, during the first two-quarters of 2013, the economy grew by nearly 4%. However, later with seasonal adjustments, the GDP tapered by 1.69% and 0.3% in the first and the second quarters respectively.

The Retail Sales Trends of Thailand

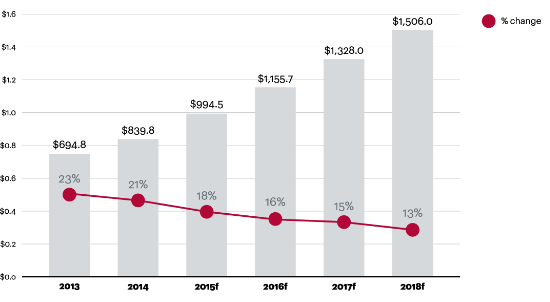

With the assumption of having a stable political atmosphere, the retail sector of Thailand is predicted to go on with its rising trajectory. But, considering the unanticipated events in 2014 and 2015, the EIU has forecasted the annual sales volume for the retail sector a growth of 3.6%, 3.4% and 4.3% for the coming years from now till 2018.

Retail Sales sector-wise

Impact on GDP:

In the past years from 1980 to 2012, the economy growth of Thailand has elevated to a great extent. The current GDP shows that in the last 32 years, its economy has extended to almost sixteen times in terms baht i.e. approximately eleven times in terms of dollars. As per the IMF, Thailand has become the 32nd biggest economy in the world. Thailand has seen five economic growth periods when we talk in terms of GDP. Its economy grew by an average of 5.4% per year during the years 1980 to 1984.

per the IMF, Thailand has become the 32nd biggest economy in the world. Thailand has seen five economic growth periods when we talk in terms of GDP. Its economy grew by an average of 5.4% per year during the years 1980 to 1984.

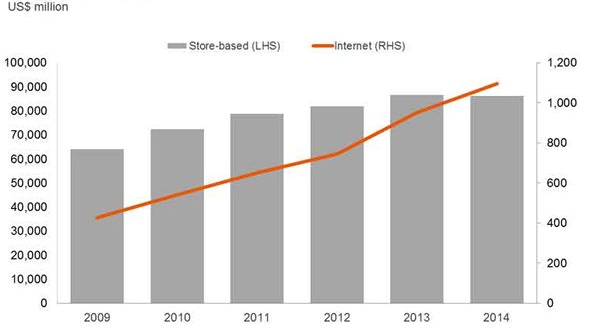

The regional businesses of Thailand contribute to 70% of GDP, with Bangkok alone accounting for almost 30%. Apart from the capital city Bangkok, the retail sector of Thailand has a stronger emerging consumer market. The retail players are launching new outlets throughout Bangkok and the non-urban locations. The increasing count of middle-class community in the country supports the growing number of outlets. The grocery sector, fashion industry, and sports products observe great popularity in the store-based channel. The consumer electronics and appliances have more of non-store retailing. The overall number of the food and non-food retail chain stores is expected to reach up to 412,640 stores and 23,618 stores respectively until 2020.

The Retail Market:

The retail industry of Thailand is basically divided into segments based on the product. The segments are:

- Home and garden

- Apparel and footwear

- Grocery items

- Consumer electronics

- Personal accessories

- Mobile and other electronic gadgets.

The key vendors that cover almost all of the above segments of the Thai Retail Sector are:

- Big C: This is one of the largest chains of grocery and general commodities retailer in Thailand. Big C operates around retail 700 stores in Thailand.

- Central: It is a family-owned firm in Thailand that deals in retailing, merchandising, operating restaurants etc. It has subsidiaries: Central Pattaya and Central Retail Corporation. It has malls, retail stores and departmental outlets throughout Thailand.

- CP ALL: Thailand’s chain of convenience stores that operates under 7Eleven brand name. Around 9000 stores of 7Eleven operate throughout Bangkok and other cities.

- Global House: Basically involved in the construction materials retailing company in Thailand. It operates around 42 stores throughout the country.

- Home Pro: Home Pro is an online retailing store that deals with home furnishings, interior assets, electronic items and other household items.

There are other vendors as well that operate chains of stores in Thailand. Few to name are Adidas; AEON; Lazada Group; Nike; Seven & I Holdings; and The Mall Group etc.

Current Scenario:

The retail sector of Thailand was earlier dominated by small shops which are now replaced by new revamped retail centers, hypermarkets, and shopping malls. This is followed by the introduction of small convenience stores, led by 7-Eleven, an international chain of convenience stores that operates franchises and licenses some 56,600 stores in 18 countries. It holds 53% of the market share in Thailand. The increase in a number of hypermarkets is fueled by the foreign retail investors that are making their way into the market, even though the growth has paused for convenience stores and supermarkets. The two important competitors in the hypermarket segment are Big C and Tesco Lotus. Big C has acquired 40 Carrefour outlets and rebranded them a part of Big C and Tesco Lotus has newly introduced the Extra lifestyle hypermarket concept stores into the market.

The retail infrastructure of Bangkok also continues to develop with the addition of thousands of square meters of new retail space annually. Currently, there are approximately 1.1million square meters of new retail space undergoing constructions. Of which, 500,000 square meters of are located in the suburban areas, with 41% in midtown and 15% in downtown. Currently, the retail supply of Bangkok reached 7million square meters. The addition of six new retail centers in the city has added another 162,000 square meters of net retail space to the existing market. Besides, shopping malls contribute to the largest share of the market with around 4.23million square meters.

Additionally, the retail giants are bringing out a variety of renovation projects to magnetize new brands and customers. The important renovation projects are Siam Discovery and Central Plaza Pinkalo. Also MBK Centre and Central Plaza Bangna are part of this project. The luxury products sector of Thailand is one of the largest markets. This sector is predicted for further growth impelled by an increase in local disposal incomes and numbers of well-heeled tourists. During the past two years, more than 100 new brands have made their way into Thailand and the luxury goods stores have almost doubled since 2012.

With the penetration of internet, digitization, and increase in social media users in Thailand, the number of Thais were reported to be shopping online with their smartphones in 2014. Thailand is ranked in the top 10 on-line or e-commerce markets globally. Retailers are commencing to notice these trends and are moving towards multi-channel strategies to step into this flourishing market with the digitization of the platforms to afford new sales avenues. Numerous retailers have introduced mobile applications to prop up their new product launches and promotion offers and to generate new opportunities to attract customers.

Thailand’s retail sector is anticipated to continue growing with the scenario of its stable political environment. The Thai consumers will keep on shifting from the traditional markets concept towards convenience store and other modern trends in retail markets. High-end smartphone and the growing awareness of technology in the young and tech-savvy population are expected to drive more growth in the retail online commercial market.

The Different Retail Sectors in Thailand

- Food and Beverage: Food and Beverage (F&B) is one of the sections for a maximum of household expenditures. It is a key factor driving the retail sector of Thailand. The trend in food consumed is changing gradually along with the shift in the incomes of its population. The changes in the lifestyle as a result of the process of urbanization demand a broader range of food products in the market. Consumers are now looking for more processed foods in the hypermarkets and getting distanced from the traditional fresh foods available in open markets. Exposure to international ways of life and the popularity of foreign and processed food products is resulting in a greater demand for easily available, ready-to-eat foods.

- Consumer Electronics: The market of consumer electronics is expected to show a positive move in the coming years. An expected progress in the current political state and a possible revival of the export sector may enhance the purchasing power of customers. The consumers of the country will thus be able to buy quality products such as smart TVs and other electronic gadgets. The manufacturers are considered to introduce novel products with lower prices which will enhance market penetration amidst consumers with lower budgets.

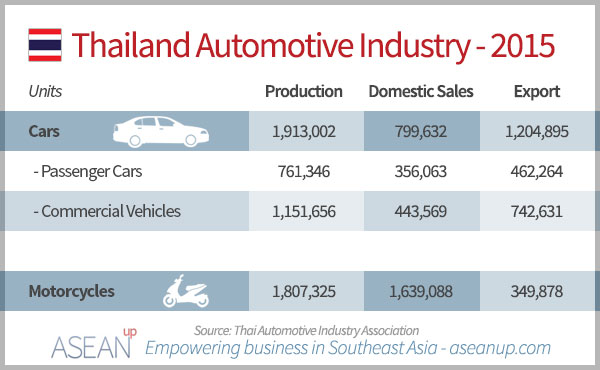

- Automobile Industry: Thailand is considered to have one of the largest automobile industries in Asia. Thailand’s automobile industry is well nurtured and forms a pillar of the industrial base. The list of automobile companies that operate in the country has almost all the names of the pioneer global brands. Ford, GM, Honda, Mazda, Mitsubishi, Nissan, Toyota etc, all have their bases in Thailand. The

manufacturers are now opting to confine their manufacturing bases in Thailand. The Thai automobile sector is gradually towards a green technology production base. The Thailand BOI has made new developments planned in the coming years. The government is keen to aid the private sectors and coerce the supply chain of the automotive market towards greater values. It is aiming to make Thailand a global base for production of green automotive.

manufacturers are now opting to confine their manufacturing bases in Thailand. The Thai automobile sector is gradually towards a green technology production base. The Thailand BOI has made new developments planned in the coming years. The government is keen to aid the private sectors and coerce the supply chain of the automotive market towards greater values. It is aiming to make Thailand a global base for production of green automotive. - Banking and Finance: Though the Thai people prefer for normal domestic banks and teller transactions, yet the penetration of Internet and mobile platforms is expected to affect the traditional banking ways of Thailand. Latest digital tools like mobile wallets and online transaction platforms signify a hopeful prospect for digital banking processes and provide extensive opportunity for the financial sector to boost revenues, and enlarge client base.

Foreign Investments Opportunities:

Thailand is a country located in the southeastern part of Asia. It is known for its beaches, historical monuments and huge numbers of metaphorical temples of Buddha. Its economy largely depends on tourism and exports business. It is new to the industrial sector having an exports ratio of around two-thirds of its gross domestic production. But, the Thai economy is currently hitting minimal growth that is expected for the year. The World Bank anticipates a growth of 2.9% in 2016 for the country.

According to Board of Investment of Thailand, the Foreign Business Act of 1999 regulates the supervision of foreign investment in the country. Any foreign investor interested in investing either in the retail or wholesale sector in the country is needed to acquire a Foreign Business License from the Director General of the Commercial Registration Department of the Ministry of Commerce and also get an approval from the Foreign Business Committee. There are certain exceptions to the above-mentioned license requirement in the case of foreign investment in the retail sector that have investment plans of more than 100million Baht and 20million Baht in the case of retail stores.

Shift Towards Modern Retail Market Trends:

The retail market of Thailand has fascinated a wide array of both domestic and foreign retailers all striving to achieve their share of the consumer market. This has resulted in the creation of a highly viable environment. The economic growth of the country in the past years has brought about the quantitative extension of the retail sector. It has also made an elemental shift in customer liking, taste, and actions.

Eventually, the old traditional stores are getting gradually but insistently erased out and taken up by new retail marts and shopping malls. This result is being compounded with a swarm of small convenience stores growing across the country. In 2015, a large number of retail brands continued to affirm to be from amongst the major players within the market. Companies like CP All; 7-Eleven; Tesco Lotus supermarkets and hypermarkets; Central Retail; Big C and Home Pro were all seen vibrant and active in the retail sector.

This move in the trend of malls and hypermarkets in Thailand is greatly influenced by similar developments across the country as multinational retailers keep on entering the market. But, it has been seen that the sales growth has been left behind that of the traditional convenience stores and supermarkets. However, the structure of the hypermarkets in Thailand is somewhat peculiar in an aspect as their products and market environment usually search for imitation of the old traditional markets. This is a strong point in the retail sector.

These casual domestic markets usually have a number of open stalls and vendors selling a variety of foods and eatables including meat; fish; fruits and vegetables and this stands as a tough competition for the newbie hypermarkets. But the marketing strategy of the hypermarkets also tends to beat the local sellers by offering all that is absent or not available in the traditional markets. The hypermarkets sell a wider range of new varieties and fresher qualities of food along with providing modern lifestyle goods and products.

Along with improving the stock of retail space expected to come up in the approaching years, retailers are also getting on a number of renovation tasks so as to attract new companies and consumers. Few of the renovation projects are Siam Discovery, MBK Centre, and CentralPlaza subsidiaries.

According to Pascal Billard, the CEO of Central Food Retail Group, the retail sector has been flexible in the last few years in spite of slow economic growth. And the wholesale segment is said to keep growing, with the convenience stores and supermarkets tending towards higher annual growth.

Future Forecast:

The retailing industry is expected to turn out to be more interesting and overpowering in the years to come. It is estimated that the number of new retail outlets multiply exponentially. Also, new contemporary outlets will be launched to meet the needs of the consumers. Though online retailing or e-commerce business is at its budding stage in Thailand currently, yet is it expected to rise greatly with the spread of Internet and social media at such a faster pace in the coming years. The launch of future generations of the internet and its impact will surely drive the expansion of e-commerce market. This will be the key trend that will attract new investors and consumers in the retail industry in the next few years.

Digitization will have much greater penetration and direct impact on the sales output. The impact will be clearly visible in sales trends. The established retail pioneers in Thailand will need to think out of the box and focus more on domestic demand as well as international markets trends. Social media like Facebook, Twitter, Instagram etc, will be integrated to marketing industry in depth as the digitalization boosts the connectivity in the country.

Consumers will get the option to shop online via their smartphones and computers with ease. The introduction of mobile apps by companies will find a place in the market. Retailers will have to add on various payment options like money transfer, credit cards, PayPal and related apps for the convenience of the consumers. The fixed stores and outlets will make a shift towards multi-chain approach. Online shopping will become much more significant. Domestic retailing will target international tourist along with the local buyers and consumers. These strategies will add greater value to the sales figure.