Global Information Technology Sector

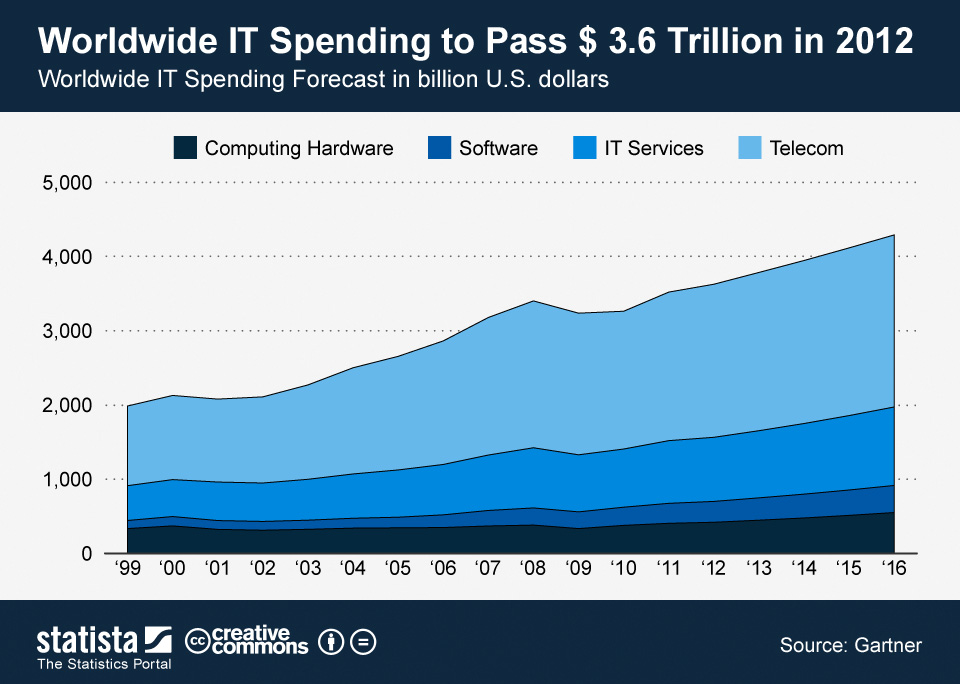

As per the research conducted by the consultancy IDC, the global IT market consisted of services related to hardware and software, and telecommunications. The expected estimate of the market in the year 2015 was about $3.7 trillion which was to be upgraded in 2016 by $3.8 trillion. IDC marked US market for almost for contributing 28% of the total estimated amount which is a slightly more than a $ 1 trillion. Even the Asian countries like China fuelled the market by their tremendous performance. In the current time, China has given stiff competition to the US with the intelligent distribution of resources and the shift has stirred other countries in Asia too.

With the help of proper channels, the IT goods and services reach the common people from the producers and give extraordinary facilities to ease their lives. The channels, continuously strive to supply IT services to the required customers and support their needs. Another good that the IT has done to the world economy is employing a huge number of people in technical departments as well as non-technical departments. According to the report, IT Industry Outlook, 2016, it can be estimated that more than 5.04 million people are employed out of the total population by the end of the year 2015. In the very same year, the growth rate of the IT industry was the maximum.

There are different definitions of the concept of IT industry. However, the basic thing that occurs in the industry is an intermingling of different disciplines and using the expertise to make a single integrated system make the life of the people easier. Each segment of the framework has much to contribute to the economic development and growth of the society. The well-being of the society is also related to the services of the IT sector. Over the years, in spite of many ups and downs, the IT sector had a great impact on the world economy and helped the nations to recover from the devastating situations.

With the development of the digital business, the growth of the IT has been aggravated to a great extent. IDC says that the core IT industry accounts for 59% of the total revenue earned by the industry whereas the telecom industry has accounted for 41% of the global IT market. Most of the revenue is earned by the micro sized IT firms than the large establishments. The huge number of people the sector employees is contributing to the improvement of the world economy along with the economy of different nations. The requirement for technology has become so unavoidable, that the dependency on the IT sector has grown over the years.

The IT industry is one of the biggest industries that has been contributing to the growth of the global economy over the years. With the increase in the demand for the core service, people are getting more interested in the IT sector for more income. Though the sector faced quite a number of problems, yet they emerged victorious every time with the help of their services and their products that are offered to the economy.

IT Sector in Thailand

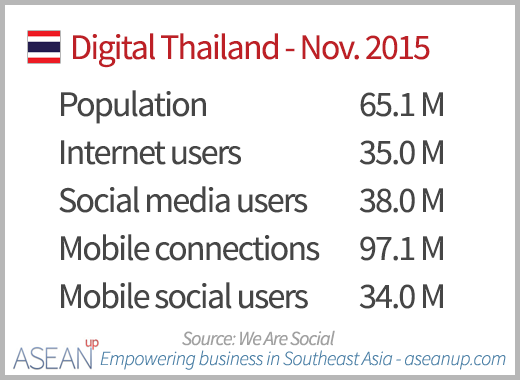

The government of Thailand, for the past decades, were committed to positioning the nation as one of the leading hubs for information and technology services with the help of improving infrastructure. The government has also tried their best create a pool of talents offering an excellent environment to work in the multinational countries. Sideways, they have also helped in developing the micro-sized firms so that the nation can boost of their personal innovation other than the international organisations. in the present time, it has been claimed that Thailand is one of the leaders offering best IT services and products to the nation as well as to the international people.

According to PR Newswire, the IT sector of Thailand has received a kick start in matters related to foreign demand for the products and services related to IT. IT outsourcing has also received a very excellent demand from the global organisations. many firms have established their base in the land of Thailand to take the profit from the trained professional IT workforce, excellent infrastructure and innovative selves. Thailand is considered to be enjoying a rank of the eighth position on the basis of outsourcing of IT services to the other potential countries. The qualified workforce that the nation owns is one of the main reasons that Thailand is improving day by day and holding on to a rank in providing IT services to other countries and firms. Outsourcing of IT services and products contributed a lot to the development of the IT sector in Thailand where demand is received from nations like the US. PR Newswire is of the opinion that 43% of the organisations of US are using services from the Thai IT companies. it is estimated that the IT sector of Thailand would grow to a $18.9 billion in the next few years. the most determinant for which leading organisations seek IT outsourcing services from Thai companies is that the constant support of the government and the dedication that it shows in strengthening the sector.

Outsourcing of IT services and products contributed a lot to the development of the IT sector in Thailand where demand is received from nations like the US. PR Newswire is of the opinion that 43% of the organisations of US are using services from the Thai IT companies. it is estimated that the IT sector of Thailand would grow to a $18.9 billion in the next few years. the most determinant for which leading organisations seek IT outsourcing services from Thai companies is that the constant support of the government and the dedication that it shows in strengthening the sector.

The Thailand Board of Investment (BOI) is happy to see the development that has been occurring the sector over the years. BOI is in a constant process of improving the condition of the IT sector through the development of the infrastructure and required workforce. The target is to attract foreign companies in availing IT services from the Thai IT firms. However, the demand of the IT is growing rapidly and foreign organisation are seeking their help to establish their firms with proper services. The spirit of the Thai people working in the IT sectors in outstanding and continuously striving to replace their position from the eighth to the top.

IT sector in Thailand is one of the major contributors to the national income providing a lot of employment to many people. This workforce is built right from the initial stage and made them eligible to carry on the services.

Contribution of the IT sector to the nation

The information technology sector in Thailand has contributed a lot of to the nation not only economically, but also in many other ways. This has brought the much-required globalisation to the nation that was much required to appreciate the efforts of the government to make the nation, one of the developed ones with the help of strong infrastructure. With the developed IT services and products, the nation is one of the leaders in providing leading IT services to most of the established and top firms. And, on the contrary, different countries are seeking refuge in Thailand’s IT services as they are quite impressed with the leading developments and the continuous government support.

Since most of the work in the current business world is dependent on the computer system, the need for the IT services has also increased. With more demand, the companies earn huge dollars contributing to the economy of the nation. The huge developmental projects supported by the governments are done from the revenue that is earned from the sector along with the foreign investments. With the help of the revenue that is earned, the government uses it for the other developmental programmes like training the young workforce and making them eligible for the sector, education and health care. PR Newswire reported that training for the workforce began at the very higher education level.

Another notable contribution that the IT sector has given is the employment of a huge number of people. Since a good number of people are trained and educated, it becomes much easier for the organisations to pick and employ them. In this way, there is a huge number of the population who are employed in the IT sector. This is another way through which the government of Thailand collects revenue and is a contribution to the national economy.even people from the neighbouring countries come into the nation to seek the job. This way they are contributing to the global economy to making an overall development.

With the development of the IT sector, it has contributed a lot to attracting foreign investments, not only in the sector but also in the other sectors of the nations. Many of the organisations, seeking IT services and products from the country, established their firms in Thailand so that they can easily avail the service. However, this has also created new employment and contributed largely to the economy. the foreign investors try to establish their own research, in a process, developing the nation’s growth. the government of Thailand made an attempt to provide service to the education system and the healthcare system by connecting the services of the IT sectors. This is another great contribution that the IT sector has provided to the nation.

The contribution of the sector cannot be ignored and the government is trying hard to develop the sector through the creation of effective infrastructure. Workforce and support are the length of the IT sector in Thailand.

Drawback seen in Thai IT sector

There was news published by Reuters, which clearly showed that Thailand was becoming less competent and technology sector was leading them to downfall. The technology sector was called outdated and it had negative effects on the economy of the land. By the end of 2015, there was a cry that Thailand’s economy was badly affected by the organisations in the technology department of the IT sector. This was due to the outdated methods used to produce the same good with a different appearance. Moreover, the sales had gone down and the people were less interested in the products and the services.

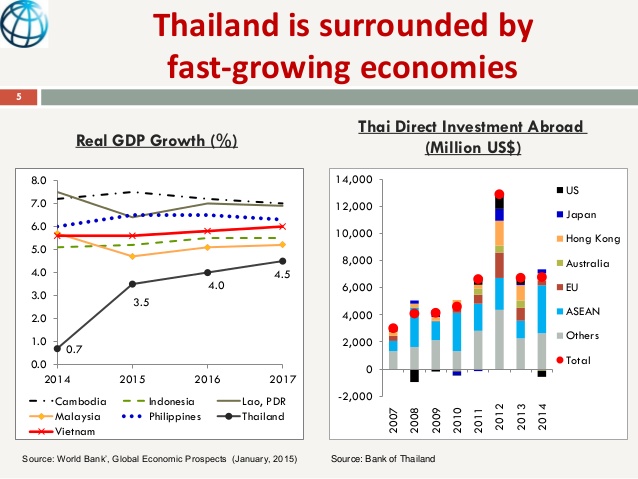

LG electronics decided to close their production of television ion the plant located in Thailand. Reuters were of the opinion that they were shifting their production plant to Vietnam which was very close to china and cheap labour were available there. since most of the people working in the IT industry are trained and knowledgeable before they enter in the sector, hiring them was becoming difficult for the organisation. This was a setback to the economy of the nation. A huge loss of income shattered the reputation of the government of attracting foreign investors. The organisation was looking for cheap labour which was not possible in the nation.

This was a setback for the nation where they enjoyed booming technology industry. however, late 2015, the LG company decided to leave the market and move to the other ,market where they would get better opportunities to launch their products. smartphones and tablets were giving stiff competition to the television producers and hence they decided to leave the market. The index for manufacturing fell for the organisation for the consecutive 22nd time. hence, they felt it better to shift to a profitable land. People were interested in the low-cost products with the same features. This was another reason for the decline of the organisation. However, this was a matter of concern for the economy of Thailand. The political disturbances created a lot of destruction tot the economy of the land.

Big organisations are opting for low-cost production so that they can give the best to the customers at very low cost. Thailand is known for their innovation in every field. However, a sudden change in the technology needs time to be adapted and this is the current problem with the Thai It sector. Even their ranking in the field of innovation decreased from 33 in the year 2007 to 67 in the year 2014. This is a great concern for the economists of the market and is eager to find solutions to the problems that are occurring in the market.

The Thai government is trying hard to improve the structure of the sector by applying new strategies. However, this requires time and the technology sector should be patient in adopting the changes for their best results. Though Thailand market I considered being one of the best markets for IT, there are certain changes needed to hold on to the position that they enjoy.

Attempts were taken by the Thai government to sustain effective IT sector

Functioning of any sector without the help of the government is not possible. It is only with the support of the government that the organisations can maintain their long-term functionality. The IT sector in the Thai market has reached the heights and achieved the success due to the effective support of the government right from the very beginning. However, the government of Thailand, from time to time, took effective measures to sustain the developments that took place in the IT industry. From providing support to arranging funds to the sector the government has done all to help to make the nation one of the largest IT hubs of the world.

The very thing that the government has done to improve the condition of the IT sector is providing training to the citizens of the nation. Right from the higher education, the students are given training in regards to software and hardware so that they get ready by the time they reach the age to be employed. Training is provided free of costs so that most of them get to know the details of the working procedure. Thus, in such a manner, the organisations in the IT sector find it easier to employ employees when they need to recruit. Some of the institutions provide education in exchange for money. The attempt of the government is to be appreciated. This very try of the organisations has enabled the nation to create a place for them in the long run.

The government of Thailand has always tried to help the IT sector by providing them with the environment for working independently and freely. Without the help and support of the government is not possible to function properly. The policies and the laws are made in favour of the organisations so that they can earn the best revenue for themselves. This would indirectly contribute to the economy of the country. Moreover, the infrastructure required building the successful IT sector is done the government of Thailand. All the resources are readily made available to IT industries so that they can use them and earn a profit. It is acclaimed that the economy of Thailand has been developed by the help of the government. Though there was seen certain disturbances in the technology sector due to the upheaval in the government, very soon it was rectified and a stable condition was gained.

The IT sector that operates in Thailand is one of the best hub providing services and products most leading companies of the world. With their help, the line of people has become much easier and well-being is simpler. Since the business world is driven by technology, the need for the IT sector is felt very much. Thailand remains to be on of the best IT outsourcing country with the help of the government. It is estimated to grow over the years.