Thailand is being counted in the list of nations with upper-middle income economy in the year 2011. From last few decades, Thailand has been making notable evolution in economic development, thereby shifting from a less-earning to an upper-income nation. Conversely, the average growth has declined to 3.5% in the period of last 10 years i.e. between 2005 and 2015. The government has got on board a motivated development program to lift its growth pathway and attain greater earnings status. Thailand’s economy mainly depends on its exports. And, amongst the highest budding industry in Thailand is the plastic industry. In the past ten years, the plastic products exports increased by nearly 26 percent yearly, which is higher than other industry exports that grew at an average of 19 percent.

The industrial resources of Thailand make the country a great hub for the plastics industry, and the government of Thailand has implemented active methods to enhance investment into the booming and emerging sector. The well-built agricultural sector of the country and the sustaining government associations make it an idyllic spot for plastics sector investment.

Forecasts and Impact on GDP:

As result of the Government support, the percentage of plastic industry products exports amplified from 2.1 percent to 3.8 percent in a period of ten years i.e. 1988 to 1998, compared to the total manufactured exports of Thailand. As per the world trade chart database, in the year 1998, Thailand got the rank of the eighth-highest plastic products exporter in the world and the leading exporter of plastic products in Asia. Simultaneous to the improvement in the exports, the plastic industry delivered rise of 0.48 percent per year in the overall productivity. Also, during the years of greater economic growth in the period between 1986 and 1989, the productivity of plastic industry products grew at a higher rate i.e. at 8.1 percent.

According to reports, in the year 2015, the value of the exports made by plastic products (3916-3926) made a total of 1,085,942 tons. This showed that the industry exports dropped by 4.4 percent when compared to that for the year 2014. The products that actually decreased the exports by such a big percentage were monofilament, plastics for covering floor and packaging products like belt conveyors etc which were approximately 149 percent 19.3 percent and 6.5 percent respectively when compare to that of the previous year i.e. 2014.

showed that the industry exports dropped by 4.4 percent when compared to that for the year 2014. The products that actually decreased the exports by such a big percentage were monofilament, plastics for covering floor and packaging products like belt conveyors etc which were approximately 149 percent 19.3 percent and 6.5 percent respectively when compare to that of the previous year i.e. 2014.

In the year 2016, the economy of Thailand is expected to inflate by taking motivating measures of expenditure and investment of the public that are the growing trends these days. Additionally, the partner countries have begun doing better in the economy. The Thai currency is expected to fall, and the prices of crude oil will probably decline at the same time. As a result, all these factors will positively affect the plastic industry and its productions.

Imports and Exports

The import value of the plastics products (3916-3926) during the first ten months i.e. Jan to Oct, in the year 2015 was nearly 622,279 tons, increased by 4.04 percent compared to the Jan to Oct period of the past year i.e. 2014. Products that increased as exports were the floor covering plastics, building components, tube or pipe, and monofilament. The plastic items that were imported from Thailand were mainly done from China, Japan, Malaysia, and the USA, which contributed to approximately 27.3 percent, 24.7 percent, 8.2 percent and 6 percent respectively.

The plastics exports sector (3916 -3926) that was nearly 1,085,942 tons, made a decrease by 4.4 percent during the first ten months i.e. Jan to Oct, in the year 2015 when compared to the Jan to Oct period of the past year i.e. 2014. This was resulted due to a decrease of exports to the most important markets like the US, Japan, and the Cambodia-Laos-Myanmar-Vietnam (CMLV) countries, and also a fall in the product prices in sequence with the universal oil prices. All these affected the gross production of the plastic products. Also, reports and forecasts show that the imports of plastic products (3916 – 3926) will increase by approximately 4 percent. Important materials which grew up as exports were plastic coverings for floors, plastic tubes, and pipes, and plastic monofilaments. All theses made a fall by 24.5 percent, 13.4 percent, and 10.6 percent, respectively.

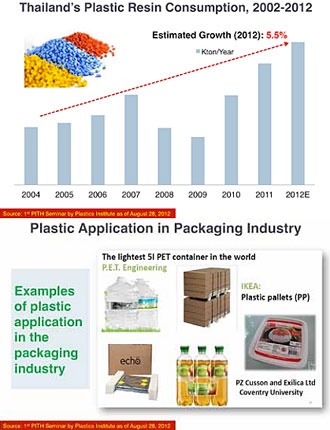

Development of the Plastic Industry

Thailand’s The Plastics Institute had conducted a seminar named “Thailand Plastics Industry Development”. The crucial rationale of the seminar was to advertise the new Industrial Intelligence Unit, which consists of information and data of all the industries like automotive, retail, petroleum, plastics etc. Keeping in view the country’s policies, the institute highlighted on the tactics that will improve the plastics industry of Thailand in order to decrease the reliance on other countries to import plastics and plastic products.

It brought up mainly six strategies that are listed out below:

- Boost the HR perspective in all the verticals and sectors inside the plastics industry.

- Raise the plastics industry such that it turns out to be a green industry which is environment-friendly. And, strive to reduce the wastage of plastics in the country.

- Enhance the development of a database for plastics industrialists’ in Thailand.

- Encourage additional access to market and finances with the purpose of improving the competitiveness within entrepreneur.

- Raise and endorse research and development and other advanced technologies for producing from upstream to the downstream industry.

- Analyze and issue the laws relating to product standards, so as to put a stop to the substandard items to be spread in the nation.

Thailand is currently holding a repute of being a strong player in the plastics industry and has developed the assets and infrastructure required to become a worldwide leader. As per the International Trade Center, Thailand has become ASEAN’s second largest country to export plastics products following Singapore. The country was also placed in the 20th position in the world in the year 2012. At present, Thailand possesses 3,000 plus domestic companies in the plastics industry. The large existence of Thailand in the manufacturing of plastics products makes sure that there are well-known industries in the plastics products manufacturing field.

Government Initiatives

The government of Thailand has taken a dynamic step in supporting the bio-plastics industry with an aim to make the nation to become the hub for bio-plastics for ASEAN region. The Thai government has allotted the National Innovation Agency to build a nationwide roadmap to increase the bioplastics industry in the country. Additionally, the administration also gives a number of enticements to prop up investment in the bioplastic industry.

The government of Thailand has a well-built set-up in the in-house technical and industrial associations and international contracts to sustain the bioplastics sector. The National Innovation Alliance of Thailand has an alliance with organizations and universities to promote methodological developments and improvements in bio-plastics field. The country’s government also has a tough set of connections consisting of institutions like the Thai Bioplastics Industry Association for additional expansion of the bioplastics industry.

The Thai Bioplastics Industry Association has signed an MOU with international institutions to assist in build synchronized certification courses and programs and technical- based exams and disclaimers for bioplastics products. The memorandum of understanding also supports added teamwork in fields like technology development, capacity building, and development of markets to increase the worldwide growth of the bioplastics sector.

The country’s government worked with the drawn in organizations to construct the plan to encourage ventures in the plastics industry. The National Innovation Agency is considered as the main controller to implement the roadmap into realistic projects. As per the outline of the roadmap, the Government of Thailand will shore up the erection of a plastics resin factory.

Moreover, there are more additional steps taken that will speed up the plastics industry progress. They are:

- Allowing the usage of raw materials from starch and sugar at prices that are fixed for export

- Giving tax incentives for R&D in the bioplastics industry

- Implementing degradable plastics standards which have certification from international standards

- Curbing the duties on import for bioplastics resins which are not manufactured in the country

- Encouraging and backing the usage and growth of bioplastics items that are produced and launched in the market.

Five Year Plans

The government of Thailand has implemented two five-year plans for promoting the Plastics industry in the country. They are:

Phase I (2008-2012):

The National Bio-plastics Roadmap project of Thailand is a five-year plan for the period of 2008 to 2012. The project was passed by the cabinet of Thailand on July 22, 2008. The decision passed a budget of $60 million. The project that aimed to make the country the leading player in the bioplastics industry, had four main strategies and was estimated to enhance the growth of $183 million in the bio-plastics industry of Thailand.

Phase II (2011-2015):

The National Bio-plastics Roadmap of Thailand has been made to carry on to the second phase for the period 2011 to 2015, representing the victory of the first phase. This demonstrates that the nation’s government is committed to making itself the regional boss in the bioplastics industry. The Thai government has promised significant funds, which includes a $10 million grant for the erection of a 30 percent public- 70 percent private bioplastics resin factory. The phase II of the National Bio-plastics Roadmap project is aiming to toil on specific parts like as improving the promotion in markets and environmental management by going green, R&D, supply chain management of biomass and incentives for business and other privileges.

Current and Future Prospects of the Plastic Industry

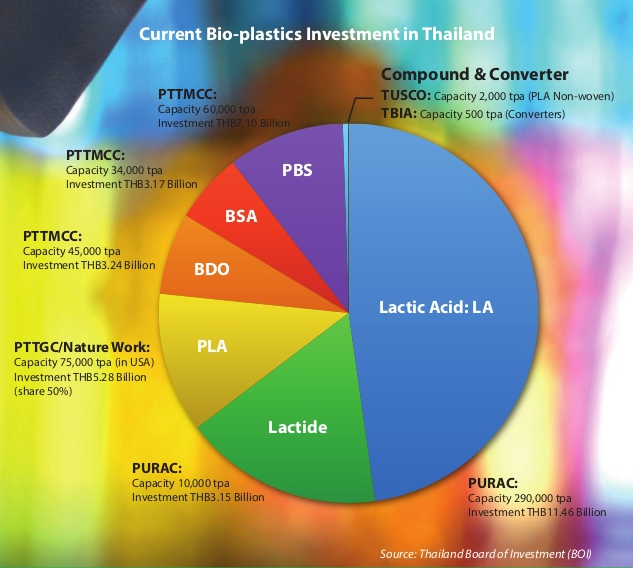

The plastics industry roadmap of Thailand and a complete range of incentives by the government of Thailand to promote ventures in the plastic sector have fascinated more and more number of plastics companies like as PURAC [lactic acid and lactide], PTTGC/ Nature Work [PLA], PTTMCC Biochem (joint venture of PTT and Mitsubishi Chemical) [Bio-Butanediol, Bio-succinic acid and PBS].

As Southeast Asia is being projected to turn into the biggest plastics manufacturing province in the coming decade, Thailand is preparing itself to become the area’s hub for plastics products and is striving to enforce its roadmap, implement new novel technology and construct its infrastructure and the plastics industry.

Conclusion

The financial system of Thailand is an appealing merge of a well-built agricultural vertical along with urbanized industrial sector and firm service sector. Even though the agricultural sector has been taken over by the industries, it still makes a good contribution to the GDP of the nation. The manufacturing and the service industry play their roles as well. The economic growth of the country is greatly dependent on the export which adds approximately up to 75 percent to the total GDP. And, plastic industry plays a major role in the exports sector and contributes to the GDP of the nation.